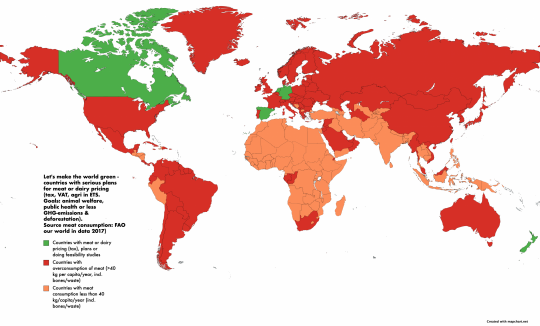

Increasing number of countries start taxing meat and dairy

A few months before the COP26 Climate Conference starts in Glasgow, more and more countries, now five in total, announced they will start taxing meat and dairy, already do so or consider to do it:

During the COP26 Climate Summit the UK Minister of Environment announced a carbon tax on meat and dairy : https://www.dailymail.co.uk/news/article-10147129/George-Eustice-signals-support-levy-foods-contribute-global-warming.html . Later, he explained this would be a carbon border tax on meat and dairy: https://www.energylivenews.com/2021/11/08/government-considers-putting-carbon-border-tax-on-imports/

Spain, Switzerland, New Zealand, Germany and the Netherlands. The EU Commission last month announced a new report on the 'polluter pays principle' adopted in agriculture and food in reply of critics of the European Court of Auditors about the lack of effective climate policies in EU agriculture & food sectors.

Countries with a meat tax

* Spain increased its VAT tariff on meat in 2011 from 8% to 10% and reduced VAT tariffs on vegetables and fruits to 4%.

https://www.oecd.org/tax/consumption/consumption-tax-trends-spain.pdf

https://www.tas-consultoria.com/blog-en/rates-vat-spain/

* Switzerland introduced taxes on meat. More info:

During the Swiss national Food System Dialogues participants discussed the need for carbon pricing food. The Swiss government will make an update for its Sustainable Development Strategy 2030 and include this topic in the revised version 2024-2027: "reflecting the true cost of food in prices and distributing the added value in fairer and more equitable way among value chain actors", including additional federal policy measures. https://summitdialogues.org/wp-content/uploads/2021/09/National-Pathway-for-Food-Systems-Transformation-in-Support-of-the-2030-Agenda-Switzerland_cleared-for-distribution.pdf

Countries who announced a tax on meat and dairy

* New Zealand announced to bring meat and dairy farms into the ETS system for GHG-emission reduction by 2025. During the UN Food System Pre Summit 28th July 2021, the Agriculture Minister of New Zealand told this in a Ministerial Declaration. This means that animal farms will have to pay for the GHG emissions they emit in 2025 and later. Tariffs are discussed; but in previous document low tariffs were mentioned. Farmers can also receive funds for reducing GHG emissions eg. by carbon farming / sequestration.

More info:

https://www.cooneyleesmorgan.co.nz/regulate_on-farm_emissions

https://www.agmatters.nz/topics/he-waka-eke-noa/

* The German Agriculture Minister proposed an 'animal welfare levy' on meat, dairy and eggs. The German Parliament agreed with the Borchert Commission plan for an animal welfare levy on meat, dairy and eggs, with revenues for farmers. A feasibility study was presented in March 2021 and two or the largest political parties in elections (CDU/CSU and the Greens) both have this Borchert Commission plan in their election program, so a future German tax on meat, dairy and eggs is very likely. More info: https://www.euractiv.com/section/agriculture-food/news/germany-plans-transformation-for-more-animal-friendly-stables/

* Denmark proposed a CO2 tax by 2023 for all sectors, including agriculture: https://www.bloomberg.com/news/articles/2020-12-08/denmark-raises-co2-taxes-on-businesses-to-fund-green-transition

In a new legislative agreement on a green transition of the agriculture sector presented last month, it is specifically stated that the government will revisit the possibility of introducing a CO2 tax in 2023. In the agreement, it says "The revisit must be seen in connection with the framework for a uniform CO2e tax in sectors that are not currently tax-covered and which will be determined in connection with the second phase of the green tax reform." (Danish text here: https://fm.dk/media/25215/aftale-om-groen-omstilling-af-dansk-landbrug.pdf)

Countries considering a meat tax or environmental taxation in the agriculture sector

* The Dutch Agriculture Minister developed several feasibility studies on a meat tax to be implemented by the next government. More info: https://tappcoalition.eu/nieuws/15991/dutch-ministry-of-agriculture-and-dutch-parliament-want-food-taxes-to-finance-sustainable-agriculture

https://www.omnicomprgroup.nl/case-study/how-logic-enticed-the-dutch-to-pay-more-for-their-meat/

The Dutch government announced a 1,45 billion euro package till 2023, to pay husbandry farmers to stop farming and reduce the number of animals for environmental reasons. https://apps.fas.usda.gov/newgainapi/api/Report/DownloadReportByFileName?fileName=Dutch%20Parliament%20Approves%20Law%20to%20Reduce%20Nitrogen%20Emissions_The%20Hague_Netherlands_12-28-2020

In June 2023, the Dutch government mentioned a meat consumer tax to be introduced to fund payments to farmers for ecosystem services of 600 million euro per year, starting in 2026, in the draft Agriculture Agreement. By september 2023 the proposals will be sent to the Dutch Parliament.

South Africa announced a carbon tax in all sectors, including agriculture. The agriculture sector will be included in the GHG emission tax scheme after 5 years.

* The EU Commission announced in the EU Green Deal for food (F2F Strategy) that fiscal systems and food prices have to reflect external environmental costs like GHG emissions. A study is announced about the implementation in the EU of the 'polluter pays principle' adoption in the agro/food sector: https://www.eca.europa.eu/Lists/ECAReplies/COM-Replies-SR-21-16/COM-Replies-SR21_16_EN.pdf The EU Commission mentioned the need for a higher meat price in Farm to Fork Strategy and zero percent VAT tariff for vegetables and fruits: https://tappcoalition.eu/nieuws/14050/eu and https://tappcoalition.eu/nieuws

The EU Parliament will vote 9 and 10th September 2021 about the Farm to Fork Strategy. It is expected all political groups will support amendment nr. 18 including a proposal allowing EU Member States more flexibility to have a 0% VAT tax on healthy food products and increase VAT taxes to the highest level for foods with negative impacts on public health or the environment. https://tappcoalition.eu/nieuws/16831/increasing-number-of-countries-start-taxing-meat-and-dairy-

Countries with National Determined Contributions (Paris Climate Agreement) to reduce meat consumption:

Switzerland:

-'Meat and dairy production must be locally adapted and may need to be reduced while avoiding compensatory imports from abroad triggered by unchanged demand.'

Finland:

'The objectives of the Climate Food Program are: to increase the share of fish and plant products in the average Finnish diet; to reduce the consumption of meat to a moderate level; to make the production of meat and dairy products more sustainable'