Danes will decide on agri-CO2 tax or meat tax this summer

An expert committee in Denmark presented a Green Tax Report on February 21 for a CO2 tax in agriculture in 2027 with the aim of significantly reducing non-energy related climate emissions from agriculture (especially methane and nitrous oxide). Additionally, research has been conducted on the effect of a tax on meat and dairy. The question was whether such a tax could result in a lower CO2 tax in agriculture. However, this effect is very limited given the relatively large livestock (export) sector. Danish greenhouse gas emissions are expected to reach 12.4 million tons of CO2 equivalents in 2030, with agriculture accounting for a whopping 46 percent share. This share has increased enormously because other sectors significantly reduced their CO2 emissions, while agriculture did not do so in the past 10 years, similar to the rest of the EU. The Danish Climate Act aims for a 70% reduction in CO2 emissions by 2030 (compared to 1990), which also applies to agriculture. The idea is that each sector receives the same CO2 equivalent tax so that the macroeconomy suffers minimal disadvantages.

The TAPP Coalition, which aims for fair prices on meat and dairy, including all costs for the environment and climate damage, is pleased that Denmark is the first EU country to seriously work on CO2 pricing in agriculture, and possibly also a consumer tax on meat and dairy. TAPP's Danish partner organization, Dansk Vegetarisk Forening (the Danish Vegetarian Association), is closely involved in the developments and lobbying. In the coming months, stakeholders will discuss the report to provide advice to the politicians. This includes labor unions, agricultural organizations, and NGOs. Subsequently, the government will make a decision, expected this summer. Previous studies indicated that CO2 pricing in agriculture could lead to a 25 to 45% reduction in the livestock sector. The new research shows much more limited effects (2.6-15%).

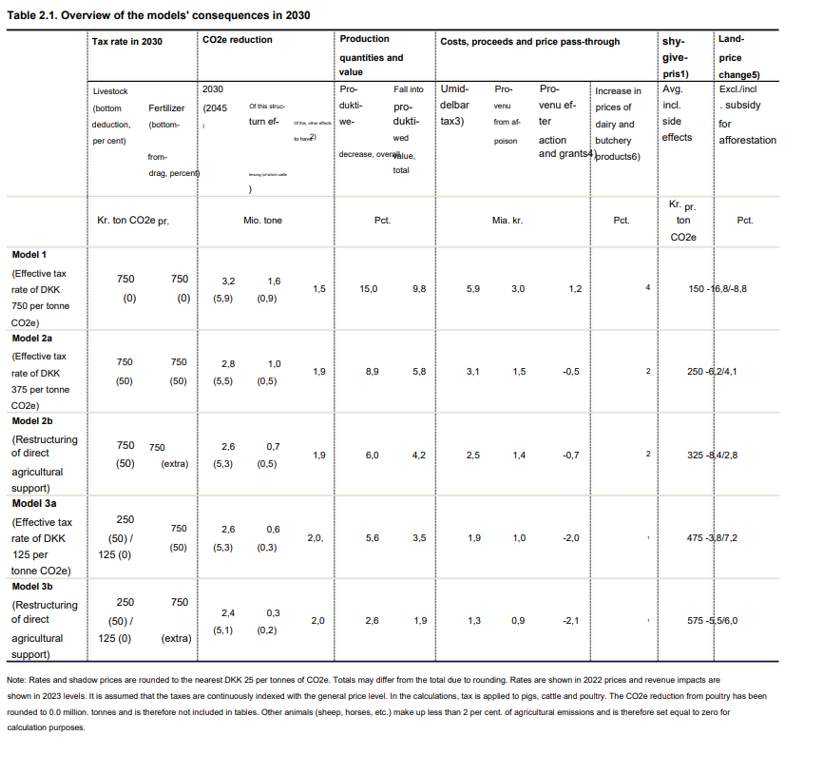

The report outlines three models, with subsidies also being used in all models to sequester CO2 in agricultural soils, funded from the revenue from the CO2 tax in agriculture. Model 1 introduces a tax of 100 euros per ton of CO2 equivalents, resulting in a reduction of 3.2 million tons of CO2 equivalents. With this model, the climate targets for 2030 would be achieved, but this comes with a significant negative impact on agriculture, with a predicted production decrease of 15%. Model 2 applies a tax of 50 euros per ton, and Model 3 a tax of 16.75 euros. Model 3 has the least far-reaching effect, still achieving part of the targets (reduction of 2.4 million tons), but also predicting a production decrease in agriculture of 2.6-5.6%. In model 1, consumer prices of meat and dairy increase by 4%, in model 2 by 2%, and in model 3, prices do not increase (see table).

The budgetary consequences also vary between the models, with Model 1 being the most costly and also having employment effects. However, these effects are considered relatively limited, given the small share of the agricultural sector in total Danish employment and the capacity of the current labor market to easily absorb these changes. The models are expected to have no net income effects and not disturb social balance.

In addition to the CO2 tax for farmers, brief attention has also been paid to a consumer tax for carbon-intensive supermarket products. According to DR, economists have calculated that this could lead to a maximum 6% increase in prices of meat and dairy products. Danish Finance Minister Jeppe Bruuns mentioned a tax on beef last year, as this type of meat accounts for 55% of the food carbon footprint in Denmark. The wealthiest ten percent of Danes buy twice as much climate-damaging beef as the average, and three times as much as the poorest ten percent of Danes. Beef is an example of how wealthy people are responsible for much more CO2 emissions than poorer people, says Kristian Kongshøj, an associate professor at Aalborg University, where he researches climate and inequality. He suggests that a beef tax could be introduced in a way that does not increase income inequality, a political requirement. In that case, the revenue from the tax must be used for a green check for all Danes or for compensations for the lowest income groups. The ruling Moderate Party wants to halve the VAT on vegetables (currently 25%) along with the beef tax, so that everyone is compensated.

A consumer tax has the advantage for farmers that it does not affect (untaxed) exports, while imported products are also taxed in supermarkets, but the disadvantage is that it is difficult to calculate, there are many retail locations to tax, and there is no CO2 reduction goal at the Danish and global levels for consumption (only for production).

Tax on meat and dairy

The analyses of the expert group indicate that a CO2 equivalent tax at the production stage on emissions from individual agricultural enterprises is a much more targeted and cost-effective means to meet Danish national climate objectives and international climate obligations than a climate tax on the final consumption of food. The reason is that a consumption tax exempts emissions from the extensive Danish food exports and the associated domestic deliveries of agricultural raw materials, and it does not encourage individual farmers to develop and use more climate-friendly production methods. For these reasons, the introduction of a tax on final consumption will only allow for a very limited reduction of the tax at the production stage if Denmark's territorial climate objectives, including the 70% target, are to be achieved, and the socio-economic additional costs of a consumption tax will be high. Furthermore, an implementable climate tax on final consumption is considered a less accurate tax on the actual climate impact than a tax at the production stage (although averages can be used). Based on this, a climate tax on final consumption is not included in the presented models. But, the committee did emphasize that a Danish CO2 tax in agriculture should be aligned with future similar measures at the EU level. In November 2023, the EU presented proposals for an EU Emissions Trading System (ETS) for agriculture, which could potentially take effect in 2030. This would involve greenhouse gas quotas that decrease annually, allowing for the trading of emission rights. At the time of implementing such an EU system, a Danish CO2 tax could be repealed or reduced.

It is expected that a political decision on the specific form of the Danish CO2 tax for agriculture and/or food products will be made in the summer of 2024.

You can find the complete translated Danish report here.